Tax Investigations

Indiana Jones

"Nice try kid, but I think you just brought a knife to a gunfight."

Will I be picked for a Tax Enquiry?

Any system of self-assessment must contain an enquiry power for the tax authorities as part of its mechanism. So HMRC have the right to enquire into any tax return which is filed.

HMRC enquiries may go beyond this and can cover company tax returns, VAT and excise issues and PAYE returns of employers.

HMRC and AI

HMRC says it's Connect AI system has over 55 billion items of data (currently 6100 gigabytes) relating to taxpayers. This data is used to target taxpayers for tax investigations. (See https://en.wikipedia.org/wiki/Connect_(computer_system)).

The Connect AI system trawls data from many sources to identify potential cases of tax evasion and avoidance. The data is obtained from a wide variety of sources, including :

• Estate agents / rental agents

• Banks

• Investment companies / crypto currency platforms

• Web browsing and email records

• Social media

• Flight sales and passenger information

• DVLA records

• E-retail platforms

• Individual and corporate tax returns

• The Land Registry

• UK Border Agency

• Credit card records

Although the Connect system allows HMRC to analyse billions of data points, it is an incredibly complex system. Using AI to highlight potential investigation cases can easily produce ‘false positives’ and trigger investigations into innocent individuals.

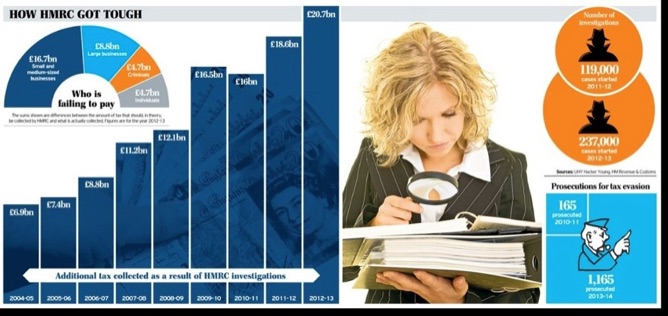

An Increase in Investigations

From 2022 to 2023 HMRC tax investigations into individuals and small businesses have increased by 16,000 additional cases to a total of 232,000 per year. HMRC are reliant on their AI technology to select these cases although the specific criteria used by HMRC for selection are exempted from disclosure under a Freedom of Information Act exemption.

According to a Freedom of Information request made by Thomson Reuters, HMRC opened 23% more inquiries into unpaid VAT, a total of 109,400 in the last financial year.

There was a 21% rise in tax investigations into sole traders and small businesses between the 2020/21 and 2022/23 tax years.

However, a recent Freedom of Information request from UHY Hacker Young found that approximately 267,000 of tax investigations into small businesses and self-employed professionals between 2019/20 and 2021/22 failed to achieve a tax settlement, which suggests that HMRC's AI strategy is putting taxpayers through the stress and cost of an enquiry for no reason.

The Scope of Enquiry

Most often, a tax enquiry into a self-assessment tax return will concentrate on one specific aspect. For example, if you have disclosed a redundancy settlement on your tax return then HMRC may want to check that it has been correctly disclosed as the taxation of severance payments is a complex issue.

Beyond that, if HMRC has information which conflicts with your tax return they may open an enquiry to investigate the issue. If you have made one error in your tax return there could well be others and HMRC have a duty to check that possibility.

In some cases, HMRC may have gathered sufficient intelligence data to believe that the disclosures on your tax return do not match your lifestyle and in these cases they will consider a full enquiry into the whole range of your financial affairs in order to satisfy themselves that the tax returns have been filed correctly.

For the most serious cases, HMRC have the power to take criminal proceedings as they are a prosecuting authority under UK law.

I guess it's not a problem if my tax return is correct?

Tax enquiries are full of traps for the unwary. What might start out as a short meeting with the tax inspector in order to discuss a few points can soon turn into a nightmare with the taxpayer inadvertently giving the inspector ammunition to make assumptions about her lifestyle - and therefore pushing up the potential settlement tax bill.

The unrepresented taxpayer can often inadvertently open up new areas of enquiry thereby prolonging the enquiry and increasing the risk of a tax cost.

The link below relates to a website dedicated to exposing the methodology used by HMRC in tax investigations :

The Burden of Proof

UK criminal law works on the assumption of “innocent until proven guilty”. Unfortunately, in a tax enquiry the opposite is true.

Where HMRC have found an error they will use this as a lever to extrapolate figures which assume that you have committed the same error consistently throughout the period of the enquiry. This can lead to a large tax bill.

It can be difficult to prove that the tax inspector’s figures are wrong and even with a good accountant on your side this can be an expensive and lengthy process.

In recent times a worrying trend has appeared at tax tribunals where the tribunal has found evidence of HMRC officers to be unreliable, inaccurate, or both. In the recent case of Roger Preston Group Ltd v HMRC the judge criticised HMRC’s attempt to change its arguments over issues that had been resolved in two earlier tax enquiries. In the VAT case of Pavan Ltd HMRC made fundamental errors which were reinforced at internal reviews and still decided to take a flawed case to tribunal.

Tax Penalties

When working out a settlement figure to close an enquiry, the starting point is the amount of tax which the inspector has found to be due.

Added to this will be interest charges on the tax due. Interest runs from the date when the tax would originally have been due so, for example, if the tax relates to the 2019 tax return (year ended April 5, 2019) the tax for that year would originally have been payable by January 31, 2020 and so any interest in an enquiry case will be calculated from that date.

The final aspect of the enquiry is the penalty to be charged.

The tax investigation penalties will start at 100% of the tax due in normal tax investigation cases but can be up to 200% of the tax due.

The inspector will often agree a remission of the penalty depending upon the seriousness of the offence, the co-operation received from the person under enquiry (and their accountant) and whether the additional tax is due to a lack of reasonable care or a deliberate act.

Insuring Against the Cost

Although you cannot insure to cover any additional tax, interest or penalties which may be due as a result of a tax enquiry, you can insure the fee cost of professional representation.

A quick online search for "personal tax investigation insurance" will turn up a number of companies who can provide this insurance.

Beyond the original investigation..........

HMRC have a responsibility to look not just at the person under enquiry but also at any associated parties where an indication of wrong doing is suspected.

Also, HMRC are particularly interested in organised criminal activities including money-laundering and where necessary they will withhold conclusion of an enquiry while the scope of the original enquiry is widened.

Need Help?

Do you need help with any of the issues discussed on this page?

If you need assistance with UK tax filing we can complete and file a return for you with all tax calculations taken care of.

We can agree a fixed fee in advance.

Contact us for details