ctp

The statutory basis for UK tax residence was introduced from 2013 and from that date the concept of ordinary residence was abolished. For periods before April 6, 2013 different rules applied.

The basic structure of the residence test consists of three tests:

-

Automatically non-UK resident test

Automatically non-UK resident test -

Automatically UK resident test

Automatically UK resident test -

Sufficient ties and day count test

Sufficient ties and day count test

Temporary Non-Residence

Targeted anti-avoidance rules prevent people from using short periods of non-residence to receive income free of UK tax. These rules already apply to capital gains, pension scheme withdrawals and remittances of foreign income in some cases.

The rules are extended to include -

-

• dividends and other income from personal or family companies if the income came from profits which arose at a time of UK tax residence.

-

• lump sum benefits from an employment in certain cases.

The starting point is the ‘Automatically Non-Resident’ test.

Automatically Non-Resident

You cannot be UK resident if :

-

you spend less than 16 days in the UK during the tax year and you were resident in the UK for one or more of the 3 tax years before the current tax year; or

you spend less than 16 days in the UK during the tax year and you were resident in the UK for one or more of the 3 tax years before the current tax year; or

-

you were not UK resident in the previous three tax years, and you spend less than 46 days in the UK; or

you were not UK resident in the previous three tax years, and you spend less than 46 days in the UK; or

-

you were in the UK for less than 91 days and you work full-time work abroad (this includes self-employed work)

you were in the UK for less than 91 days and you work full-time work abroad (this includes self-employed work)

For the purposes of this test, work abroad is considered to be “full-time” if it is on average at least 35 hours per week over the whole tax year. Where some employment duties are performed in the UK you can spend up to 30 working days per year in the UK without overturning non-resident status.

If you do not qualify as automatically non-resident under the test outlined above then the next step is to consider whether you would be considered to be automatically UK tax resident.

Automatically UK Resident

You will be automatically UK tax resident for a tax year if :

-

you spend at least 183 days in the UK during the tax year: or

you spend at least 183 days in the UK during the tax year: or

-

your only home is in the UK for more than 90 days during the tax year and you occupy that home for at least 30 days. If you have more than one home or have a home overseas, further conditions apply: or

your only home is in the UK for more than 90 days during the tax year and you occupy that home for at least 30 days. If you have more than one home or have a home overseas, further conditions apply: or

-

you are in full-time work in the UK for a continuous 365 day period (not necessarily coinciding with the tax year)

you are in full-time work in the UK for a continuous 365 day period (not necessarily coinciding with the tax year)

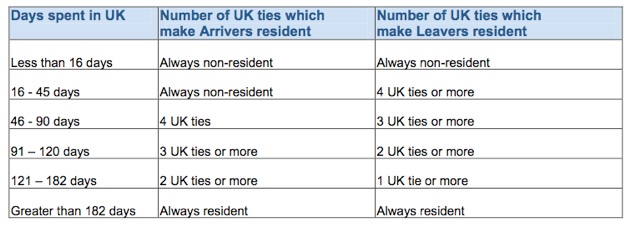

Sufficient Ties Test

In many cases it is possible to not meet the conditions of either the automatic non-resident test or the automatic resident test. In these cases you need to consider a series of further tests known as the “sufficient ties test”.

Taken together, the number of your ties with the UK and the days spent in the UK will decide your tax residence status.

Here is an overview of how the UK ties and UK days tests work together :

The UK Ties

Family Tie :

You have a UK family tie if you have

-

• a spouse

-

• a civil partner

-

• someone with whom you are living as a partner

-

• a minor child

who is resident in the UK.

A minor child who is only resident in the UK because they are in full-time education in the UK will not be considered a connecting factor provided they spend fewer than 21 days in the UK outside term time. A half term holiday will count as term time for these purposes.

Accommodation Tie :

You have a UK accommodation tie if :

You have ‘available accommodation’ for a continuous period of at least 91 days in the tax year, ignoring any gaps of fewer than 16 days.

Available accommodation is widely defined and will include a home in the UK, holiday home, temporary retreat or similar and could include the use of a hotel if the same hotel is always used.

Work Tie :

You have a UK work tie if you spend at least 40 days working in the UK, where a working day is defined as three hours.

90-day Tie:

You will have the 90 day tie if you spent more than 90 days in the UK in at least one of the previous two tax years.

Country Tie :

This only applies when you leave the UK

You will have the UK country tie if the UK is the country where the greatest number of days has been spent.

For day counting purposes, days spent in the UK at midnight are counted as UK days.

However an anti-avoidance provision will apply to individuals who manipulate this rule to attempt to qualify for non-resident status, despite spending considerable time in the UK and having substantial ties.

Days spent in the UK as a result of exceptional circumstances will not to be counted as UK days - up to a maximum of 60 days.

HMRC have confirmed that additional exceptional days will be allowed where travel has been disrupted due to COVID-19 restrictions in 2019/20 and 2020/21.

Special rules apply to anyone who avoids tax on certain types of income - such as dividends paid by a company they control or proceeds from single premium insurance bonds - while they are temporarily non-resident.

These rules apply if you have been UK resident for four or more of the previous seven tax years.

Tax residence always relates to whole tax years and the tests described above will decide if you are resident or not resident in a tax year.

However, in the year of departure from or arrival in the UK it is possible to split a tax year between periods of residence and non-residence. The split year treatment applies where you :

-

• start to work full-time overseas

-

• accompany your spouse or partner who is working full-time overseas

It also applies if you :

-

• leave the UK to live abroad and you move your home there within six months of your departure and do not return to the UK for more than 15 days for the rest of the relevant tax year; or

-

• you come to the UK to live here and your only home is in the UK; or

-

• you come to work full-time in the UK; or

-

• you acquire a home in the UK and continues to be resident in the UK in the next tax year.

Tax Residence Rules

So what are the rules?

The Statutory Tests

Day Counting - The Midnight Rule

Exceptional Circumstances

Temporary Residence Rules

Split Year Treatment

"In a funny way, nothing makes you feel more like a native of your own country than to live where nearly everyone is not."

Bill Bryson

Non-Residents and Tax Records

Non-residents who visit the UK must keep careful records of the dates of their visits to this country, as demonstrated by two recent cases*. The outcome of the cases was largely influenced by the quality of record keeping made by the individuals concerned. Taken together, just over £6m of tax was in dispute. [Rumbelow & Anor v. Revenue & Customs 2013 UK FTT 637, Glyn v. Revenue & Customs 2013, UK FTT 645].

There were similarities between these cases, but very different results for the taxpayer. The Tribunal took notice of the meticulous records of movements kept by Mr Glyn – and found in his favour - while they noted the absence of records and inconsistencies in the case of Mr and Mrs Rumbelow - and the Rumbelows lost.

“This case demonstrates that millions of pounds can be won or lost due to the quality of an individual’s record keeping,” warned Richard Mannion, national tax director at Smith & Williamson, the accountancy and investment management group.

“These cases focused on tax years before the new statutory residence test was introduced, but the need for detailed records remains paramount.

Many people spend a large portion of the year abroad, but keep ties with their family in the UK. Mannion advises: “In such cases, it is important that people keep scrupulous records of not just the date, but the time of their arrival, into and out of the UK. They should also note the reason for their visit, where they stay and where time is spent outside the UK. The extent of record keeping required will depend on individual circumstances, but a full list appears in section 7 of HMRC’s guidance note RDR3.”

-

*The two cases focused on residence status (with the rules applying before the statutory residence test in Finance Act 2013) which were at First-tier Tribunal. They concerned:

-

1.Mr & Mrs Rumbelow (TC03022) (involving disputed tax totalling approximately £0.59m between 2001/02 and 2004/05);

-

2.James Glyn (TC03029) (involving disputed tax of £5.5m for the 2005/06 tax year).

Do you need help with filing a tax return?

We can complete and file a return for you with all tax calculations taken care of.

We can agree a fixed fee in advance.

Contact us for details

ctp europe ltd © 2010-2021