ctp

Running a UK limited company and holding the office of director is a serious undertaking. As a company director you must comply with Company Law as well as the tax laws.

Because of the complexity of the rules relating to the taxation of limited companies the following commentary cannot fully cover all aspects of the subject and we would recommend that you seek professional advice before proceeding.

A detailed commentary on company law is outside the scope of this brief but you can contact us for advice.

Your company will have to file statutory accounts each year at Companies House.

For small companies no audit is required. The accounts normally have to be filed at Companies House within nine months of the end of the company accounting period. This deadline has been temporarily extended in 2020 for some companies due to the COVID-19 crisis.

Companies House will also require an annual confirmation statement / annual return (director and shareholder details) each year. This is separate from the annual accounts and will often be filed at a different time. It is important that it is filed within the time limits as the company may be dissolved for failure to file.

There are penalties for late filing and the penalties are scaled, dependent upon the size of the company.

The annual accounts must be filed within one year of the end of the company accounting period. HMRC require accounts for be filed electronically in iXBRL format with the company tax return.

The company must also file a corporation tax self assessment tax return. HMRC will also require full corporation tax computations in most cases. Again, these must be filed electronically in iXBRL format. HMRC filing deadlines have not been extended due to COVID-19.

Most companies are employers, even if the only employees are the company directors. In the case of an employing company, the PAYE regulations require the company to file -

* Monthly PAYE electronic submissions in a specified RTI format.

* Annual P11D returns of benefits in kind - by July 6th following the tax year

There are penalties, some of them severe, for late filing of any of the above documents.

We can help small companies comply with RTI obligations. Contact us for assistance.

A plc is a 'public limited company'. Most limited companies are not PLCs.

A public limited company is a company which is registered as such and complies with the following:

-

•It must state that it is a public limited company both in its memorandum and in its name. The memorandum must contain a clause stating that it is a public limited company and the name must end with "Public Limited Company" or "PLC"

-

•It must have an authorised share capital of at least £50,000 before it can commence business, a quarter of which must be paid up in cash.

There are also other technical stipulations and generally a plc is more tightly regulated than an ordinary company. An ordinary company can become a plc.

Under English law a company has it's own legal identity and is taxed separately from the company directors.

The company is chargeable to corporation tax (CT) on it's profits. From it's gross income, most expenses paid by the company are deductible and will reduce the profit for CT. The expenses will include anything the company pays to it's directors by way of salary, bonuses and benefits in kind. Companies pay CT on their capital gains, not Capital Gains Tax.

The current rate of corporation tax is 19%.

The company's taxable year is the same as it's financial year, not the year to April 5, as for income tax.

CT is payable 9 months after the end of the relevant CT period. The CT payment dates have not been extended due to COVID-19.

The burden of a director is rather a heavy one and it is recommended that the company tax affairs are kept as up to date as possible. Good bookkeeping is boring, but critical.

A limited company must have it's own bank account to keep the company money distinct from that of the owners / directors. If this is not done there can be really difficult tax issues.

The most costly mistake made by company directors is withdrawing money from their company without considering the tax implications - see below.

To be tax effective, a director will need to plan the best way to extract money from their company - either as salary, dividends or benefits in kind. This planning should be an ongoing process but the most critical time for planning is before the company reaches it's year end - so as to reduce the final profit and minimise the corporation tax bill.

At any time money is taken from the company there will be a tax charge, usually PAYE. HMRC will insist that PAYE is operated on all forms of cash drawings (salary, bonuses, etc.) and take a dim view of directors drawing money without PAYE.

We can offer a payroll service for small companies - contact us for details.

Drawings from a company must be accounted for in one of the following ways:

* salary - on which you must operate PAYE

* benefits in kind - which must be reported on a P11D or included as part of the payroll

* dividends

* repayment of business expenses paid personally

The company records should be able to identify the nature of all such payments, for reporting to HMRC.

There are benefits and disadvantages to each of the above categories and we would recommend that you seek advice on the most tax efficient methods of withdrawing money from the company.

A company can pay a dividend to it's shareholders out of profits. Because the payment is made out of profit it does not reduce the profit for corporation tax (CT) purposes.

If turnover exceeds £85,000 in any 12 month period the company must register for VAT. You must tell HMRC within 30 days of your turnover reaching this level.

However, the company can voluntarily register with a smaller turnover and this will allow the reclaim of the VAT element of all of the company costs.

If the company registers for VAT, there are strict regulations about record keeping. Unlike corporation tax, VAT relates to single transactions so the VAT invoice or receipt must be kept for every transaction related to the business.

If you do not have a limited company at present you may be considering using one to trade. If you would like to set up a new company contact us and we will make the arrangements.

Trading as a limited company will give the directors' a measure of protection against commercial creditors. A sole trader or partner is fully liable for the debts of the business and may be made bankrupt if the business fails but a company director is usually only liable for the company debts to the extent of her share capital in the company, except in cases of fraudulent trading.

However, the tax implications of forming a limited company are wide ranging and professional advice should be taken before trading as a limited company.

Only if you draw a salary. The company will pay employers national insurance on salaries and benefits paid to employees. This is a factor to consider when forming a remuneration strategy for the directors - see above.

If your company is dissolved by Companies House - because the annual return has not been filed, for example, all assets of the company at the time of dissolution will belong to the Crown.

If you arrange with Companies House to have your company struck off and then change your mind you must apply to a court to have it reinstated.

If your company is not trading you may leave it dormant until a later date. However you must still file annual accounts with Companies House - although HMRC do not usually require to see the accounts of a dormant company.

If you wish to wind the company up, and provided there are no creditors, you can apply to have the company struck off the companies register. Clearance must be obtained from HMRC before the company is struck off.

The calculation of a taxable profit figure for corporation tax is a very complex area and is dependent upon applying tax law as well as accounting principles. The subject is too large to discuss here but if you have a particular computational issue or question contact us.

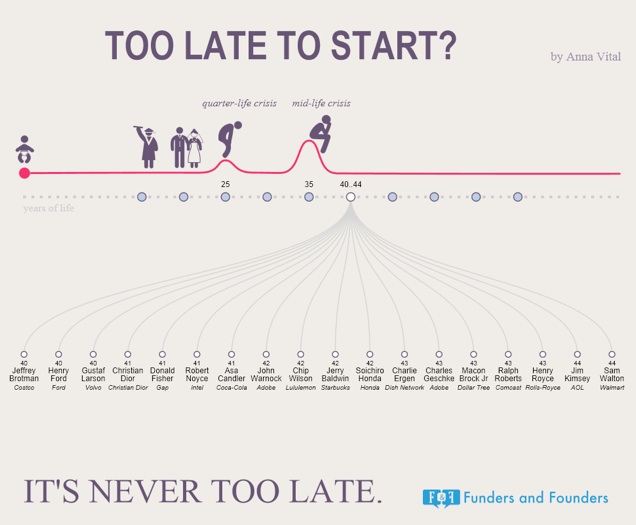

The issue of whether to run a business as a company or a sole trade or partnership is an important decision and has tax as well as commercial consequences. There are often tax savings to be had by incorporating a business.

When trading as a limited company, care needs to be taken as to how profits are drawn from the business. A mixture of salary and dividends usually produces the most tax efficient method.

For an employee / director of the company, it is usually possible for the company to make pension contributions to a registered fund.

Incorporating an existing business will often involve transferring assets from the sole trade or partnership into the new company. In some cases this can create significant capital gains although there are mechanisms for deferring these gains until any later sale of the company.

As part of the process of closing an existing sole trade or partnership, the effects of overlap relief need to be considered as this can increase the income tax charge.

Limited Companies

What obligations do company directors have?

What returns does Companies House require?

What returns does HM Revenue & Customs require?

What is a PLC?

What tax will my company pay?

How should I administer the company?

How do I draw money from my company?

What is a dividend?

Should my company be registered for VAT?

Should I trade as a limited company?

Will my company pay national insurance?

What happens if my company is dissolved?

If I no longer need my company what should I do?

How are the company profits calculated for tax?

What are the issues of incorporating a business?

"Fortunately we’re not a public company - we’re a private group of companies - and I can do what I want."

Richard Branson

More information.......

MICRO ENTITIES

New legislation came into force in December 2013 relating to the smallest companies.

For financial years ended on or after 30 September 2013 some companies may be entitled to prepare and file micro-entity accounts.

Further details are on our micro-entities page.

Do you need help with filing a tax return?

We can complete and file a return for you with all tax calculations taken care of.

We can agree a fixed fee in advance.

Contact us for details

ctp europe ltd © 2010-2021